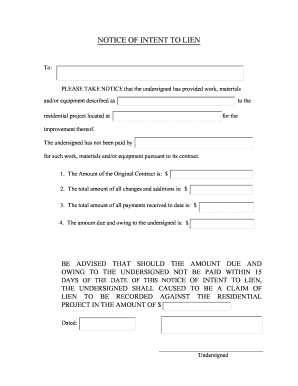

No lien claim may be filed or action brought thereon unless, at least 30 days before timely filing of the lien claim, the lien claimant serves on the owner, personally or by registered mail with return receipt requested, a written notice of intent to file a lien claim. The notice is required to be given whether the claimant has been required to give and has given a previous notice pursuant to s. 779.02. Such notice shall briefly describe the nature of the claim, its amount and the land and improvement to which it relates.

Get the free notice of intent to lien letter sample

Get, Create, Make and Sign notice of intent to file lien form

Editing notice of lien florida online

How to fill out notice of lien form

How to fill out notice of intent to:

Who needs notice of intent to:

Video instructions and help with filling out and completing notice of intent to lien letter sample

Instructions and Help about notice of intent to lien

Okay hi everybody this is mick Bernard back with another credit tip of the week now people call me all the time I want to talk about collections because collections open collections especially with balances can weigh down your credit score and so here's what I say about that be careful when you're paying off a collection because when you pass a collection it sometimes updates the date of last activity on your credit report read dates that account which means it could stay on your report for seven more years, and you really don't want that to happen and so when you're negotiating to pay a collection I'm always encouraged you to contact your collector do not just send in a check a make your payment because you received a letter in the mail because you want to convince them to remove it from your credit report paying a collection will not make your score go up in fact it might make your score go down so when you're paying those off make sure you're getting the maximum bang for your buck and that is make that collection company remove it all together if you're unable to do that we're masters at that please contact us we'll be happy to assist you with those items as always this is Mick Barnard I'll be back next week with another credit tip for you guys

People Also Ask about notice of intent to lien florida template

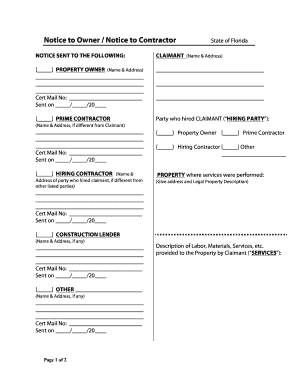

What is the intent to lien form in Florida?

Does Florida require a notice of intent to lien?

How do I file a notice of lien in Florida?

What is a Notice to Owner of intent to lien Florida?

What is the purpose of Notice to Owner in Florida?

What is a notice of intent to file lien in Florida?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lien notice to owner for eSignature?

Can I create an eSignature for the intent to file lien letter in Gmail?

How do I complete how to file a lien on a property in florida on an iOS device?

What is notice of intent to?

Who is required to file notice of intent to?

How to fill out notice of intent to?

What is the purpose of notice of intent to?

What information must be reported on notice of intent to?

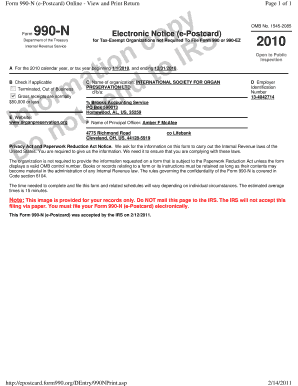

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.